“Revealing Concealed Worth: Tokenization in Real Estate, Art, and Commodities”

tokenization in real estate Envision the expansive realm of the real estate market, historically encumbered by tedious transactions and accessible primarily to those with significant funds. Tokenization is rewriting the narrative, introducing a fresh wave of accessibility. By transforming physical properties into digital tokens, investors can now acquire fractions of real estate, revolutionizing the industry.

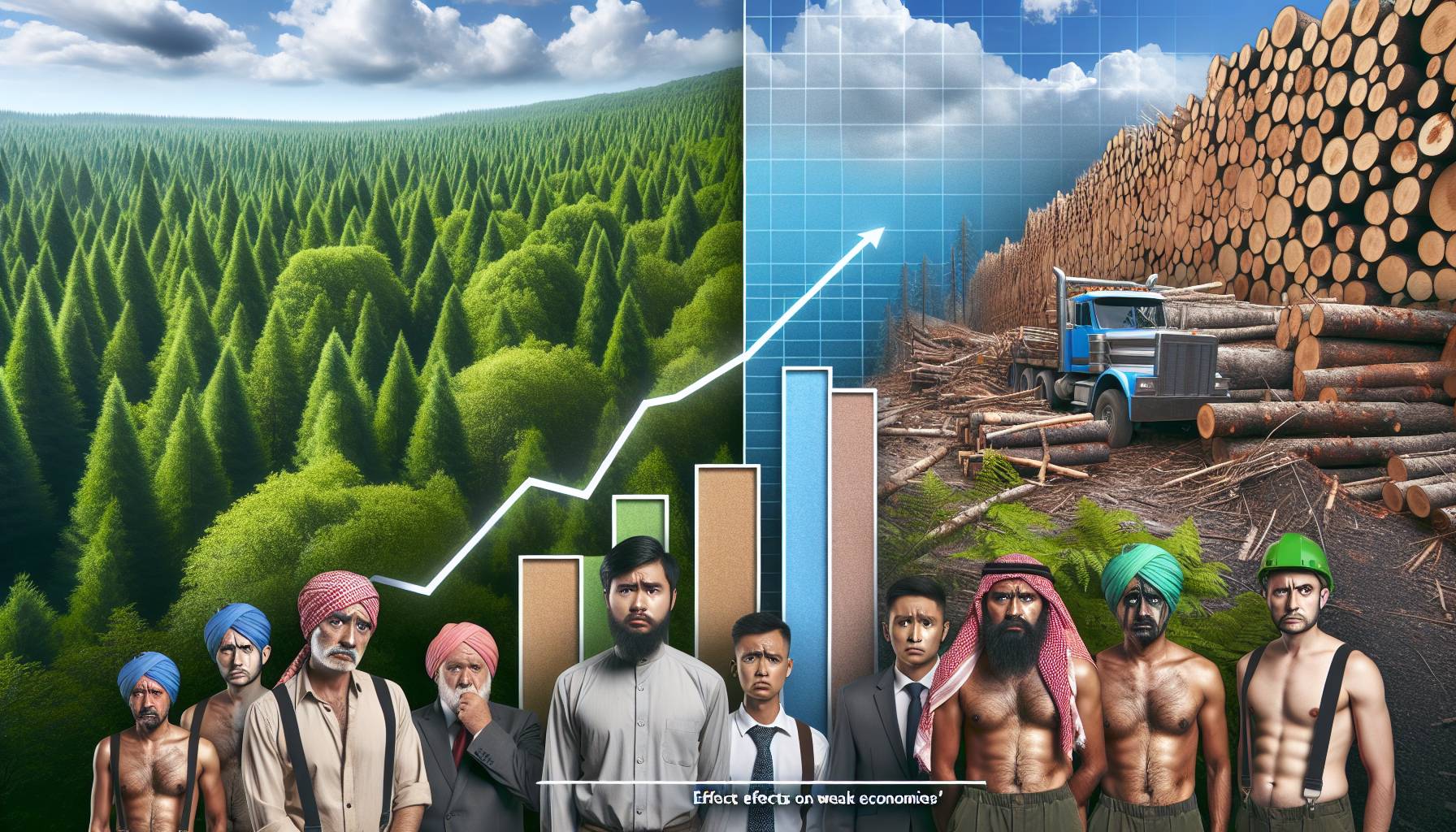

EU Deforestation Regulation: Effects on Weak Economies

Effects on underprivileged communities The recent regulation is expected to have a disproportionate impact on underprivileged communities, exacerbating current socio-economic inequalities. These groups frequently lack the means to swiftly adapt to regulatory modifications, rendering them more susceptible to economic fluctuations.

Strategic Commodity Approaches in Response to a Dovish Fed: Steering Through July 2025 Market Dynamics

Evaluating commodity market trends in a dovish setting In the constantly evolving sphere of global finance, grasping commodity market trends is essential, particularly in a dovish Federal Reserve scenario. A dovish approach generally suggests reduced interest rates, which can spur economic activity and influence commodity prices.

Australia’s Commodity Prices Drop and Market Implications

examination of commodity price movements The latest report on commodity prices in Australia for July reveals a considerable year-on-year drop of 9.0%. This reduction is striking across various essential commodities that have historically contributed to the nation’s export profits. The report points to a downward movement in iron ore prices, influenced by variable demand from major trading partners, notably China.

Oil Prices Stable Amid Tariff Worries, Set for Weekly Increases

market overview: oil price movements This week, oil prices have stayed relatively stable, holding steady amid ongoing worries about global trade conflicts. Experts note that although the market has experienced volatility tied to geopolitical issues, the prevailing trend for this week suggests a slight uptick.