Monday, 4 November 2024

Meta Platforms Stock Slips Despite Delivering Record Revenue. Is It Time to Buy the Dip?

by BD Banks

Meta Platforms (NASDAQ: META) shares slipped following its third-quarter results, despite the company posting record revenue in the quarter that topped expectations. However, investor focus once again turned to spending, with the company indicating that it would continue to ramp up its capital expenditures (capex) to take advantage of the artificial intelligence (AI) opportunity it sees in front of it.

Let’s take a close look at Meta’s Q3 earnings guidance and AI ambitions to see if investors should be buying this modest pullback in the stock.

Record results

Meta turned in record Q3 results, as its revenue jumped 19% year over year to $40.6 billion. Ad revenue climbed nearly 19% to $39.9 billion, while Reality Labs, which is home to Meta’s metaverse and the augmented reality headsets, saw revenue jump by 29% year over year to $270 million. Operating income from apps came in at $21.8 billion, while Reality Labs generated a loss of $4.4 billion. Earnings per share (EPS) surged 37% year over year to $6.03.

Family daily active people (DAP), which measures registered users who log in to one of its apps on a daily basis, increased 5% year over year to 3.29 billion on average in September. That was just short of analyst expectations of 3.31 billion. Family average revenue per person (ARPP), meanwhile, rose 12% to $12.29. Ad impressions were up 7% year over year, while the average price per ad climbed 11%. Asia Pacific was called out as helping drive impression growth.

Its newest app, Threads, reached nearly 275 million monthly users in the quarter, with the platform gaining about 1 million users a day. Meta plans to add more features to help users stay up to date on topics they care about and believes it could become the next big social media app.

WhatsApp, meanwhile, continues to gain traction in the U.S. and reached 2 billion calls made globally every day. The company also said it was seeing positive trends with young adults on Facebook, especially in the U.S. With Instagram, meanwhile, it says Reels continues to see good traction, as it continues to promote original content.

Meta forecasted fourth-quarter revenue to be between $45 billion and $48 billion. The midpoint of $46.5 billion was above the $46.2 billion analyst consensus.

Meta also once again raised the low end of its full-year capex forecast to a range of $38 billion to $40 billion, up from previous guidance of $37 billion to $40 billion. Meanwhile, it expects a significant increase in capex spending in 2025. CEO Mark Zuckerberg said the investments in AI and infrastructure, though, were critical to future growth.

The company noted that AI is helping drive both user engagement and time spent on its platforms, while also helping advertisers improve their ads and increase conversions. It said its Llama large language model (LLM) has seen tokens (pre-trained snippets of computer data that help speed AI computation) grow exponentially. Meanwhile, it is training Llama 4 with over 100,000 H200 Nvidia graphic processing units (GPUs).

Image source: Getty Images.

Is it time to buy Meta stock?

Meta founder and CEO Mark Zuckerberg is not shy about spending money in order to chase future growth. Reality Labs has been a money drain on the company given the losses associated with it, while Meta plans to significantly ramp up capex next year in pursuit of AI growth. Whether Reality Labs will pay off is a question that is still very much in the air, but the spending on AI is seeing some strong early results.

However, Meta has a long history of building out platforms without looking to initially profit from them. This is how Facebook and Instagram were built, and the company eventually was able to monetize its huge user bases through advertising to create the $1.5 trillion social media giant it is today. So if any company and CEO deserve the benefit of the doubt when it comes to spending on future growth projects, it is probably Meta and Zuckerberg.

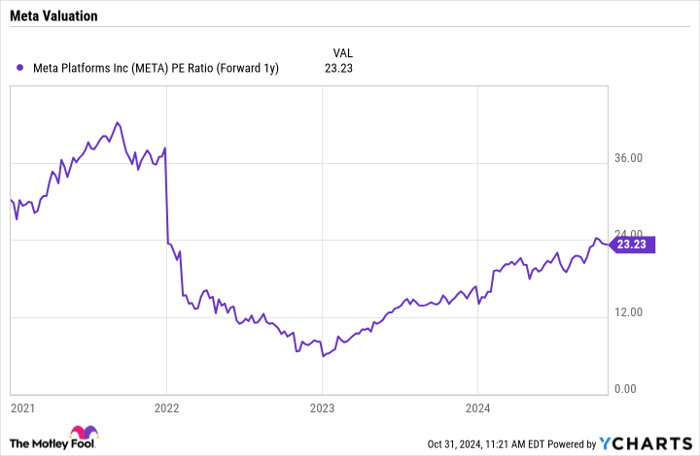

Meta should continue to benefit from the AI advancements it has made, which are leading to users spending more time on its platforms and more advertising dollars. From a valuation standpoint, the company is attractively priced at a forward price-to-earnings (P/E) ratio of about 23 based on 2025 analyst estimates.

META PE Ratio (Forward 1y) data by YCharts

Meta has proven to be a long-term winner and with the company continuing to aggressively invest in its future, I think it should continue to be a winner in the future. I’d be a buyer of the stock at current levels.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,292!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,169!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $407,758!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 28, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.